All Categories

Featured

Table of Contents

It permits you to spending plan and prepare for the future. You can easily factor your life insurance policy into your spending plan because the premiums never transform. You can plan for the future equally as quickly since you understand precisely just how much money your loved ones will certainly obtain in the event of your lack.

In these instances, you'll normally have to go via a new application process to obtain a better price. If you still need coverage by the time your degree term life plan nears the expiration date, you have a couple of alternatives.

Most degree term life insurance coverage policies come with the alternative to restore insurance coverage on an annual basis after the initial term ends. which of these is not an advantage of term life insurance. The price of your plan will certainly be based upon your existing age and it'll enhance annually. This could be a good option if you just need to prolong your insurance coverage for one or 2 years otherwise, it can obtain pricey quite quickly

Level term life insurance is just one of the least expensive protection choices on the market since it provides standard security in the type of death advantage and only lasts for a collection period of time. At the end of the term, it expires. Entire life insurance policy, on the various other hand, is considerably extra pricey than level term life due to the fact that it does not run out and includes a cash worth feature.

Trusted Which Of These Is Not An Advantage Of Term Life Insurance

Rates may vary by insurer, term, insurance coverage amount, health class, and state. Level term is a great life insurance policy alternative for the majority of people, however depending on your protection requirements and personal situation, it could not be the best fit for you.

This can be a great option if you, for instance, have just stop smoking and need to wait 2 or 3 years to apply for a degree term plan and be qualified for a lower rate.

Value Group Term Life Insurance Tax

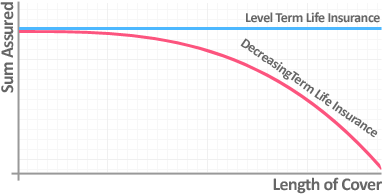

With a lowering term life policy, your survivor benefit payout will certainly reduce gradually, yet your repayments will certainly remain the exact same. Reducing term life policies like home mortgage protection insurance policy generally pay out to your lender, so if you're trying to find a policy that will certainly pay to your enjoyed ones, this is not a great suitable for you.

Increasing term life insurance policy policies can aid you hedge versus rising cost of living or strategy financially for future kids. On the other hand, you'll pay even more in advance for much less coverage with an enhancing term life plan than with a degree term life policy. If you're unsure which kind of plan is best for you, collaborating with an independent broker can help.

As soon as you've made a decision that level term is appropriate for you, the following step is to acquire your policy. Below's exactly how to do it. Compute just how much life insurance you need Your coverage quantity ought to offer for your family's long-lasting economic demands, consisting of the loss of your income in case of your death, in addition to financial debts and everyday costs.

A degree costs term life insurance policy plan lets you adhere to your budget while you assist secure your family members. Unlike some tipped rate plans that raises yearly with your age, this sort of term plan supplies rates that stay the very same for the duration you select, even as you grow older or your wellness modifications.

Learn extra about the Life Insurance coverage alternatives readily available to you as an AICPA member. ___ Aon Insurance Providers is the trademark name for the broker agent and program administration operations of Affinity Insurance Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Policy Firm, Inc. (CA 0795465); in OK, AIS Affinity Insurance Policy Solutions Inc.; in CA, Aon Fondness Insurance Policy Providers, Inc.

Proven Term Vs Universal Life Insurance

The Plan Representative of the AICPA Insurance Coverage Count On, Aon Insurance Solutions, is not connected with Prudential. Team Insurance protection is issued by The Prudential Insurance Provider of America, a Prudential Financial business, Newark, NJ. 1043476-00002-00.

Latest Posts

Funeral Insurance Policy Cost

Final Expense Insurance Market

Funeral Insurance For Over 60